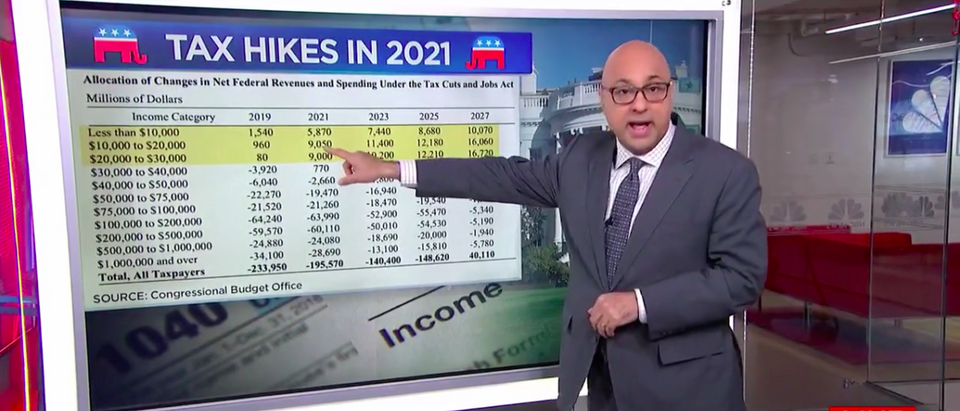

MSNBC anchor Ali Velshi misleadingly claimed on Monday that the GOP tax plan would raise taxes on low-income families.

WATCH:

Velshi used the latest Congressional Budget Office figures and charts to claim that “by 2021 people making less than $30,000 a year are going to pay between $5,000 to $9,000 more in taxes.”

“By 2027, those folks could see an increase of up to $16,000 in their taxes,” he stated.

However, the CBO chart clearly indicates that those numbers are not necessarily tax increases but rather net increases in federal revenue. In this case, the net increases in revenue are not primarily the result of those families paying more in taxes, but rather the result of those people receiving less in federal subsidies.

Put simply, those families will receive less in government aid.

The plan works out this way because it repeals the Obamacare individual mandate that requires every American to purchase health insurance. The CBO guesses that health care premiums will rise without the mandate, so lower income families might choose to opt out of the more-expensive insurance.

By opting out of the insurance, those families would no longer be eligible for certain tax credits or government subsidies to help them pay for health care.

Here’s what The Washington Post writes about the CBO’s analysis:

“The CBO and JCT analyses make it seem as if a family is actually getting money taken away from them, but in reality, most of these families making under $30,000 don’t pay any income tax. The credits and subsidies they received to help them buy health insurance were typically sent directly from the government to the insurance company. So these families are unlikely to see any changes to their tax bills.”

Most of the families making under $30,000 pay no income tax and will continue to pay no income tax under the GOP plan. It is misleading to say that they will “pay more.”